On August 14, 2025, Pakistan launched the Mobile Wallet Payment System. Now people don’t have to wait in long lines at banks or get cash by hand. They can get money directly into their mobile wallets anytime, anywhere.

This system is for everyone, especially people who don’t have a bank account. It makes sending and receiving money easy and fast for millions of people in Pakistan

Why This Launch Matters

For many years, people in villages and low-income areas faced big problems like:

- Waiting too long to get their money

- Losing money because of middlemen

- No easy access to banks

- No clear system to track payments

The new Mobile Wallet Payment System solves these problems by giving:

- Quick access to money

- Safe and clear digital records

- Less need to visit banks

- Direct connection between people and welfare programs

Launching this system on 14 August has a special meaning. It shows a step toward real economic freedom and digital progress for Pakistan

What is a Mobile Wallet?

A mobile wallet is like a small bank in your phone. With it, you can:

- Get payments instantly

- Pay bills, buy groceries, and use services

- Send money to your family or friends

- Take out cash from agents or ATMs

- Keep a record of all your transactions

The best part is that many mobile wallets also work without internet through USSD codes. This makes them easy to use, even in areas where the internet is weak

Read More: CM Punjab Green Tractor Phase 2

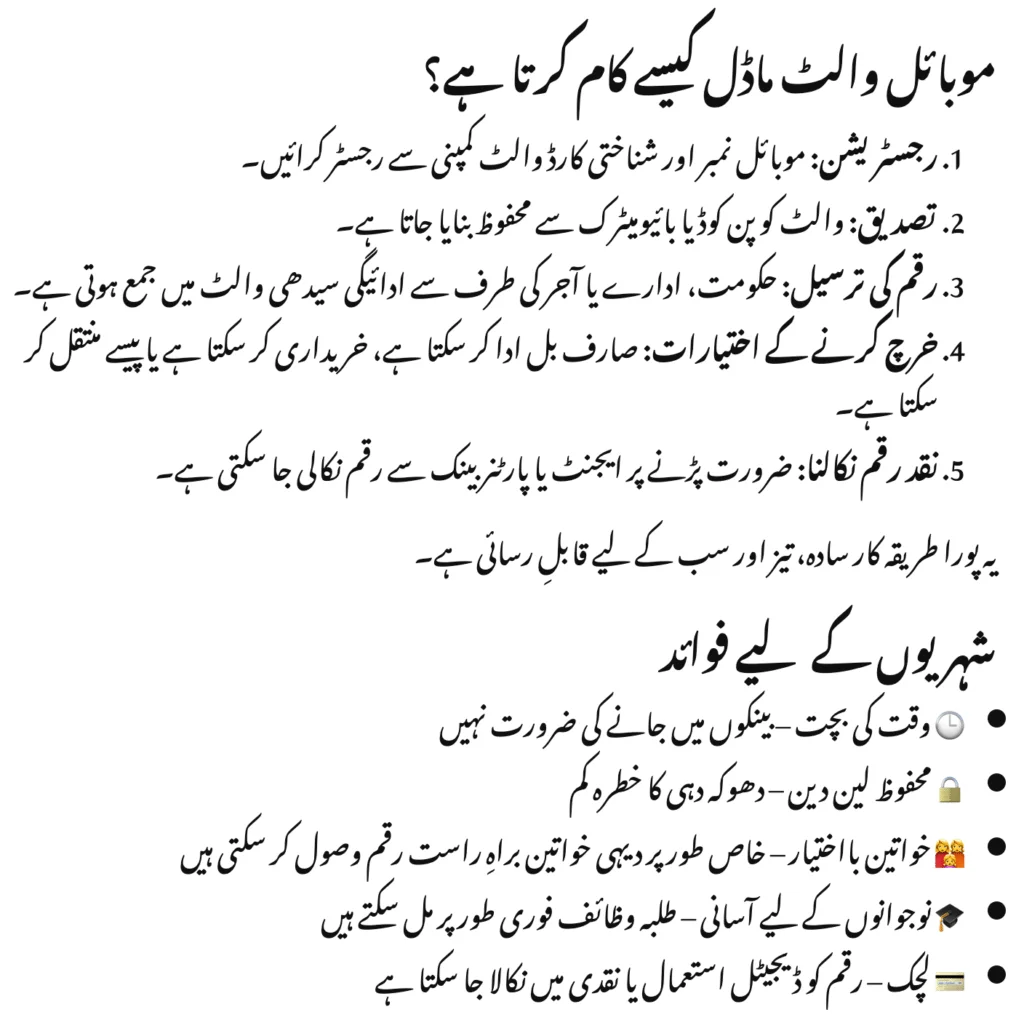

How the Mobile Wallet Works

Registration: Add your mobile number and CNIC with a wallet provider.

Verification: Protect your account with a PIN or fingerprint.

Direct Deposit: Money from the government, job, or other senders goes straight into your wallet.

Spending: Pay bills, buy things, or send money instantly.

Cash Withdrawal: Take out money from banks or local agents.

This system is simple, fast, and easy to use — especially for people who have never had banking facilities before

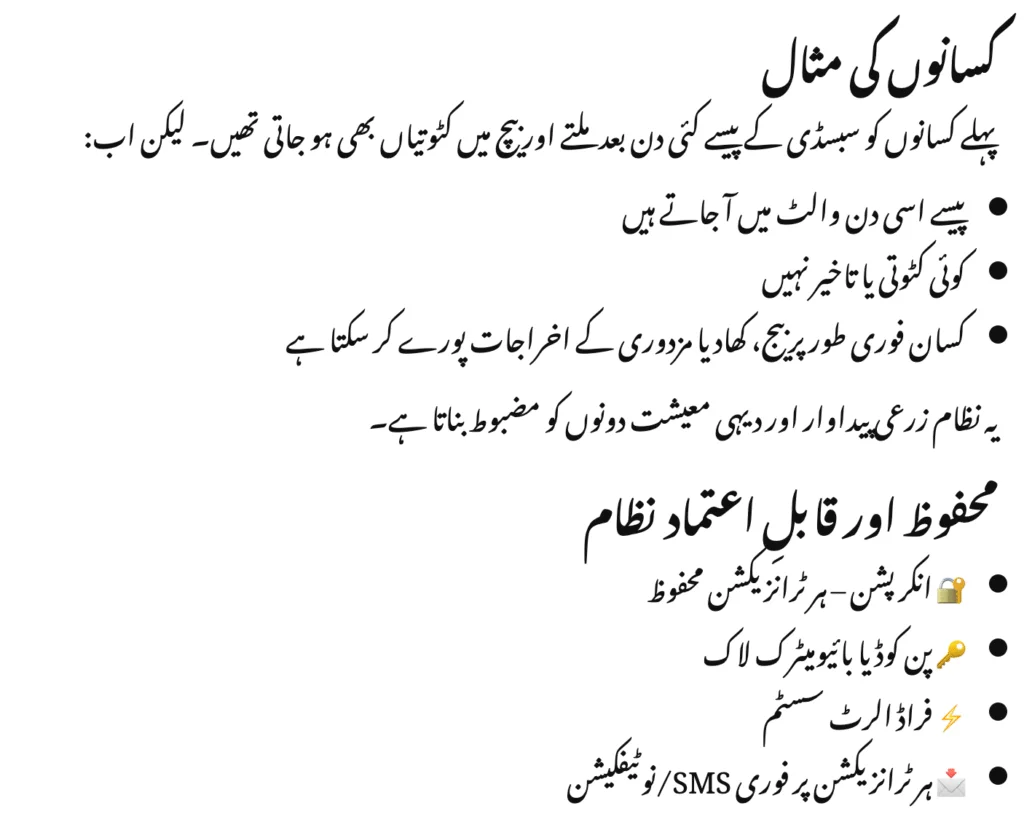

How Farmers Got Help

Before mobile wallets, farmers had to wait for weeks to get subsidy money. Many times, middlemen also cut some amount.

Now things are different:

- Farmers get payments the same day

- No hidden cuts or delays

- Money can be used right away for seeds, fertilizer, or worker wages

This helps farmers work better and makes rural areas stronger.

Security & Trust Features

The system keeps users safe and builds trust by:

- Using encryption for every transaction

- Protecting accounts with a PIN or a fingerprint

- Sending alerts if anything looks suspicious

- Giving instant SMS or app notification after each transaction

Financial Inclusion: Helping Everyone Join

Now millions of people without bank accounts can get:

- Digital accounts through mobile phones

- Direct payments and subsidies from the government

- Options for savings, loans, and insurance in the future

- Less corruption compared to cash systems

This is an important step to reduce the financial gap between cities and villages.

Global Success Stories

Mobile wallets have changed economies in many countries:

- Kenya (M-Pesa): Helped millions of people come out of poverty

- China (Alipay & WeChat Pay): Made digital payments a daily habit

- India (UPI): Handles billions of safe transactions every month

- Europe (Wero Wallet): Allows easy payments across EU countries

Now Pakistan has also joined this global change, moving forward in digital finance

FAQs

Do I need the internet?

Not always. You can also use USSD codes for offline transactions.

What if I lose my phone?

Don’t worry. Your wallet can be blocked and restored with your CNIC.

Can I send money abroad?

Right now, you can only send money within Pakistan. In the future, international transfers may also be added.

Are there fees?

Basic services are free. Only small charges may apply on withdrawals or transfers.

Who can use it?

Anyone who has a valid CNIC and mobile number

Conclusion

The Mobile Wallet Payment Model 2025 is an important step for Pakistan’s financial system. It gives people quick, safe, and clear access to their money. Farmers, women, students, and small business owners can all benefit from it.

This system reduces the need for cash, builds trust in government programs, and puts financial control directly in people’s hands.

In short, a mobile wallet is not just an app—it is Pakistan’s way forward to digital freedom and equal economic growth.